Stellantis's Aggressive Financing Strategy

Insights from Carmatic

Stellantis has recently implemented bold financing moves to enhance affordability for consumers. By reducing monthly payments, lowering annual percentage rates (APRs), and increasing incentives, the company aims to boost sales and strengthen its market position amidst fierce competition.

Our analysis at Carmatic includes automotive finance data collected daily over the past two months from 234 unique new vehicles across 32 manufacturers. By comparing the average payment calculations from September to October—focusing on 72-month loans and 36-month leases, both with $0 down—we've utilized a bottom-up approach that provides transaction-grade payment data. This method allows us to see precisely how these financing strategies directly impact Market Based Affordability.

These shifts have significant implications:

Understanding these financing trends is crucial for developing platforms that accurately reflect current market conditions, enhancing dealer tools, and improving consumer-facing applications.

These insights can inform strategic decisions around pricing, inventory management, and competitive positioning.

Payment Reductions and APR Decreases

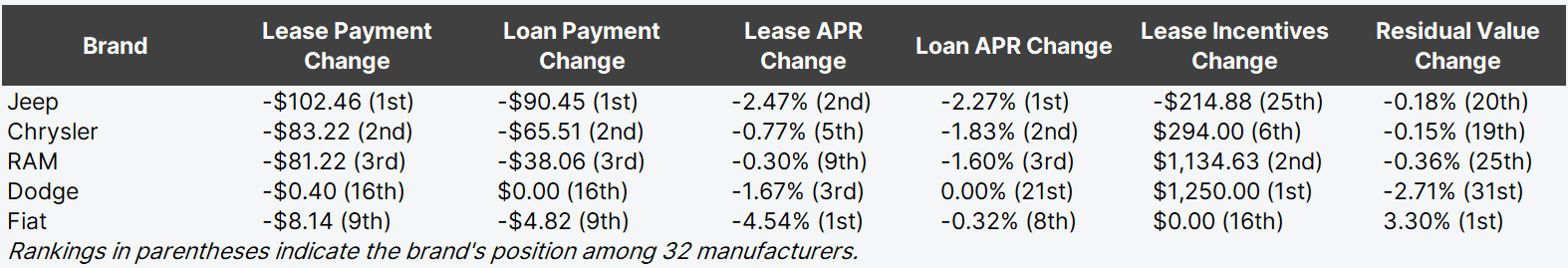

Following are the highlights of the changes in lease and loan payments, as well as APR adjustments for Stellantis brands from September to October:

Key Observations:

Jeep leads in reducing both lease and loan payments, making their vehicles the most affordable yet this year.

Fiat boasts the most substantial decrease in lease APR, enhancing the attractiveness of leasing options.

RAM and Dodge have significantly increased lease incentives, ranking 2nd and 1st respectively.

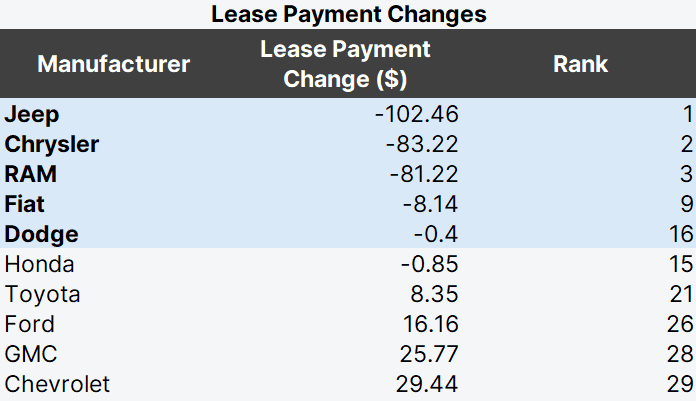

Contrasting Stellantis with Core Competitors

To fully understand Stellantis's strategy, it's essential to compare it with core competitors such as Ford, General Motors (GM) brands (Chevrolet, GMC, Buick, Cadillac), Toyota, and Honda.

Competitor Analysis

Ford

Lease Payment Change: +$16.16 (26th)

Loan Payment Change: +$15.10 (26th)

Lease APR Change: -0.49% (6th)

Loan APR Change: +0.30% (31st)

Ford's lease payments have increased, and while there's a moderate decrease in lease APR, the loan APR has risen significantly, making financing less affordable.

General Motors (GM) Brands

Chevrolet

Lease Payment Change: +$29.44 (29th)

Loan Payment Change: +$22.01 (29th)

Lease APR Change: -0.16% (16th)

GMC

Lease Payment Change: +$25.77 (28th)

Loan Payment Change: +$19.87 (28th)

Lease APR Change: -0.16% (15th)

Buick

Lease Payment Change: -$6.92 (10th)

Loan Payment Change: -$4.17 (10th)

Lease APR Change: -0.22% (10th)

Cadillac

Lease Payment Change: +$23.56 (27th)

Loan Payment Change: +$18.46 (27th)

Lease APR Change: +0.21% (24th)

GM brands show a mixed approach, with Buick offering slight payment reductions, while Chevrolet, GMC, and Cadillac have increased lease and loan payments.

Toyota

Lease Payment Change: +$8.35 (21st)

Loan Payment Change: +$4.87 (21st)

Lease APR Change: -0.17% (14th)

Toyota has marginally increased payments, with a slight decrease in lease APR, which does not significantly enhance affordability.

Honda

Lease Payment Change: -$0.85 (15th)

Loan Payment Change: -$0.03 (15th)

Lease APR Change: -0.07% (19th)

Honda's changes are minimal, resulting in negligible impact on customer affordability.

Impact on Market Based Affordability

Stellantis's strategic reductions in payments and APRs directly enhance customer affordability:

Lower Monthly Payments: Significant decreases in lease and loan payments make Stellantis vehicles more accessible to a broader range of customers.

Reduced Financing Costs: Lower APRs translate to less interest paid over the life of the loan or lease, saving customers money.

Increased Incentives: Higher lease incentives from RAM and Dodge provide additional financial benefits to consumers.

In Contrast:

Competitors Increasing Payments: Brands like Ford, Chevrolet, and GMC have increased their lease and loan payments, potentially making their vehicles less attractive to cost-conscious consumers.

Less Aggressive APR Reductions: Competitors have not matched Stellantis's aggressive APR cuts, which may impact their competitiveness in financing offers.

Conclusion

Stellantis has made significant moves to improve affordability for its customers through aggressive reductions in payments and APRs, coupled with increased incentives. These changes position the company favorably against core competitors who are either increasing payments or making minimal adjustments.

For automotive software companies and lenders, staying abreast of these developments is crucial. Integrating this data into your platforms will ensure that dealers and consumers have access to the most competitive financing options available, ultimately enhancing customer satisfaction and driving sales.

*All data based on NY, 72 month financing terms / 36m lease terms at 15k miles per year. Assumes no money down and MSRP as the sales price with excellent credit.